Revolutionize policy issuance with zero carbon footprint: A platform for effortless policy management, census filings, and avail insurances claim.

The introduction of credit life insurance programs in various countries has presented significant challenges for financial institutions, insurance companies, and insurance brokers. Manually calculating premiums, filing census reports monthly, and processing complex policy claims are now laborious and time-consuming.

By bringing all of these stakeholders under one platform, Creditlife simplifies the complicated and labor-intensive tasks leaving zero carbon footprint.

Features

All-In-One Solution for a unified credit-Life insurance portfolio management

Policy management

Redefined policy creation to manage multiple re-insurers and brokers.

Integration with Govt. services

Seamlessly integrated with authorized services for realtime notification and claim processing.

Census & Endorsement

Census data integration with the internal system, provision to upload files. No more manual census management.

Premium calculation

Provision to define own rate structure and rates.

Claim processing

Claim processing is more structured and streamlined between stakeholders with a proper approval workflow.

Seamless approval process

Claim notification to approval through a streamlined workflow.

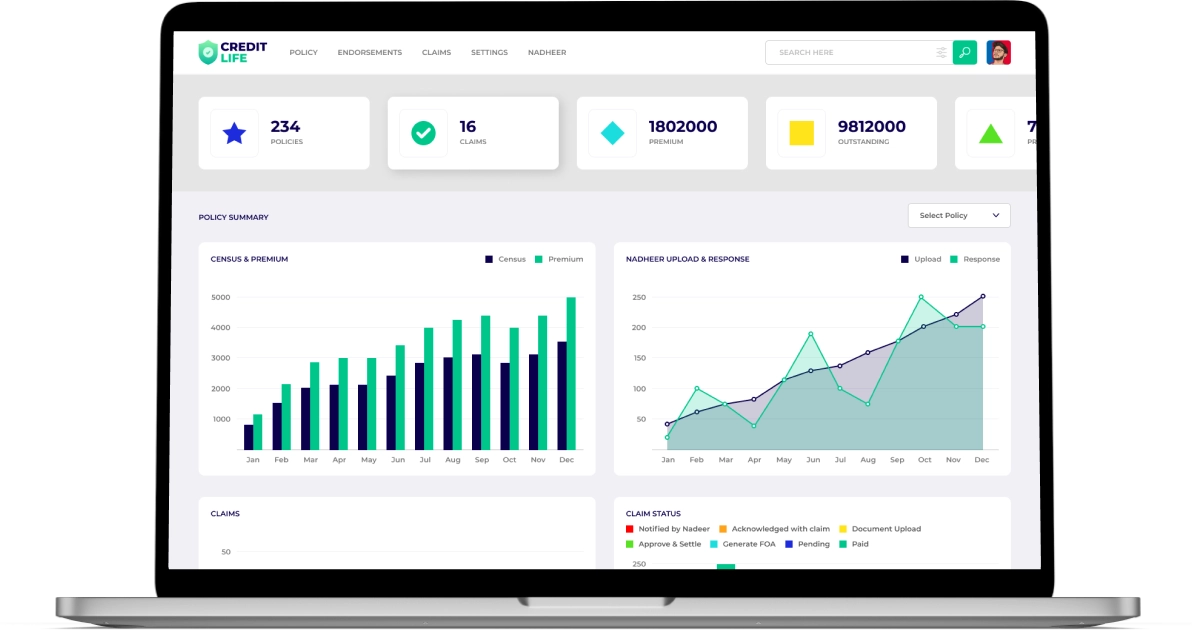

Analytics

The dashboard and reports in the platform enable data-driven policy and claim management. Knowing outstanding debts and debt management is not cumbersome anymore.

First of it's kind Creditlife enable easy management of creditlife policies incorporating multiple stakeholders. It enrich business with Realtime Death notification from an authorized source, Holistic Data reporting, and quick automated claim processing.

Insurance companies oversee multiple institutions

Financial institutions manage diverse insurers

Insurance brokers handle re-insurers and brokerages

Benefits